Why “synergy” matters now

Clean technologies don’t win in silos anymore. Solar plus batteries beats solar alone. EVs plus smart chargers beat EVs alone. Heat pumps plus rooftop PV slash bills more than either on its own. Over the next decade, these combinations—not single technologies—will drive the biggest gains in cost, reliability, and emissions. Here’s a simple tour of the most important pairings about Rise of Renewable Synergies, what the data says, and how markets are likely to evolve.

The backdrop: Demand up, costs down

- Electricity’s role is expanding. The IEA projects electricity’s share of final energy use rises from ~20% today to 26–29% by 2035, driven by EVs, heat pumps, and data centers. More “things” will run on electrons, not molecules.

- Renewables are scaling at record pace. In 2024 the world added ~585 GW of renewables, with solar ~452 GW and wind ~113 GW; renewables made up 92.5% of new power capacity.

- Storage and batteries keep getting cheaper. Global Li-ion pack prices fell to $115/kWh in 2024 (down 20% year-over-year), unlocking bigger storage projects across more countries.

- EV momentum continues. Electric car sales reached ~17 million in 2024, up 25% from 2023, with China leading.

Below are trends that set the stage for powerful “renewable synergies.”

Solar + Storage: The new baseload for sunny hours

What’s changing: Solar gives the cheapest daytime electrons in much of the world. Pair it with batteries, and you shift solar into the evening peak, cut curtailment, and firm output.

Why it matters:

- Batteries now frequently clear grid tenders because capex is falling and project sizes are scaling into the multi-GWh range across the US, China, Australia, the UK, Chile, South Africa and more.

- Every $/kWh drop increases the number of viable use-cases—from peak shaving to fast frequency response—making solar-plus-storage (S+S) a default design for new utility projects. Expect S+S to become the “standard” configuration in high-solar regions by the late 2020s. (Inference based on the cost and project pipeline trends.)

What to watch (2025–2035) About Rise of Renewable Synergies:

- Four- to eight-hour batteries are becoming commonplace in markets with evening peaks.

- Co-location rules that share grid interconnections, cutting soft costs.

Wind + Storage: Smoothing the gusts

What’s changing: Wind often peaks at night; batteries can soak up nighttime surpluses and support morning ramps.

Why it matters:

- In regions with strong wind (US plains, North Sea, parts of India and Latin America), pairing storage can cut balancing costs and help wind compete in capacity markets.

- Longer-duration storage (8–24h) and emerging chemistries will help manage multi-hour lulls, complementing short-duration lithium. (Forward-looking inference consistent with storage expansion data.)

Rooftop Solar + Heat Pumps: The home energy bundle

What’s changing: Heat pumps electrify heating and cooling; rooftop solar lowers the operating cost.

Why it matters:

- Even with a dip in European heat pump sales in 2024 due to cheaper gas and policy uncertainty, the long-term logic is intact: pairing PV with heat pumps shields households from price swings and cuts emissions. Expect a rebound as policies stabilize and building retrofits accelerate.

What to watch:

- Smarter controls that pre-heat or pre-cool when solar output is high.

- Utility tariffs that reward flexible heating loads.

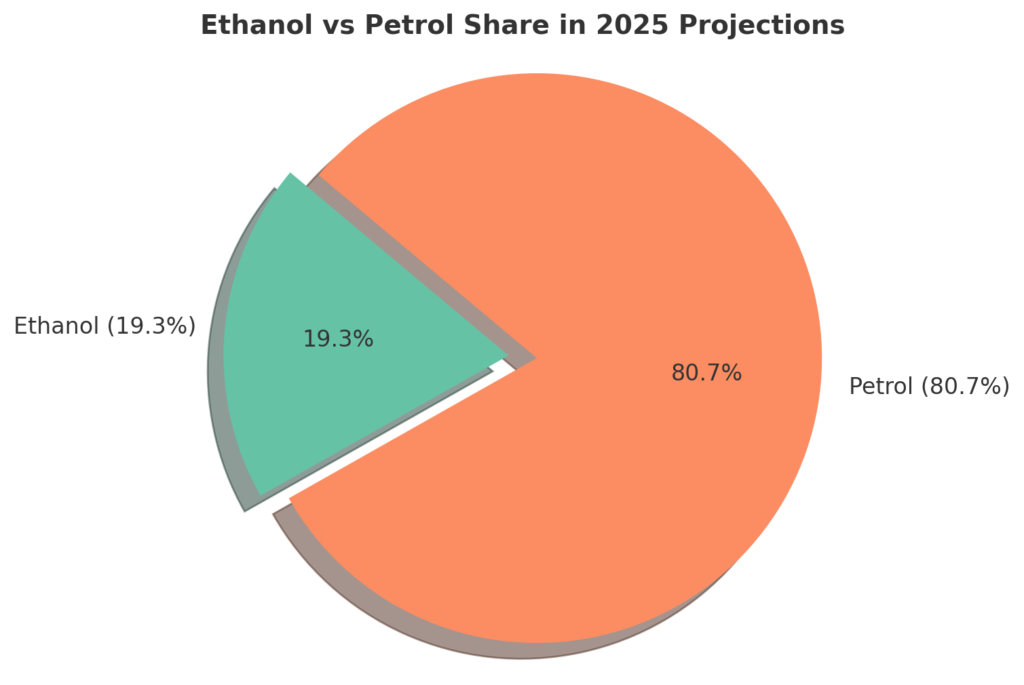

EVs + FFVs: Cars as Clean Energy Allies

What’s changing: Vehicles are no longer just about mobility—they’re becoming central to the clean energy transition. EVs act as flexible batteries on wheels, while FFVs (Flex-Fuel Vehicles) provide a low-carbon option where electrification is slower to spread.

Why it matters:

- With ~17 million EVs sold in 2024, smart charging can shift demand to cheaper, cleaner hours.

- At the same time, FFVs running on 2G Ethanol blends (made from biomass) cut lifecycle emissions, reduce oil imports, and support rural economies through biofuel demand.

- Together, EVs and FFVs offer a dual-pathway to clean transport—one electrified, one biofuel-powered—ensuring broader adoption across diverse markets.

What to watch:

- V2G standards enabling EV fleets (buses, vans) to act as grid resources.

- Policy support for higher ethanol blending so FFVs can scale quickly.

- Workplace charging and ethanol fueling stations expand in parallel, giving drivers more clean choices.

Bioenergy + Electrification: Filling gaps you can’t easily electrify

What’s changing: Sustainable biofuels and bio-based feedstocks complement electrification in aviation, shipping, and heavy industry.

Why it matters:

- Where direct electrification is hard, biofuels, biogas, and e-fuels provide drop-in options while hydrogen infrastructure matures. Expect tighter sustainability rules, more waste- and residue-based supply, and blending mandates targeting aviation and marine sectors. (Generalized view consistent with IEA and IRENA transition pathways.)

Five Big Synergy Playbooks (2025–2035)

Clean Firm Power: Biofuels + Renewables

- Solar and wind supply cheap power, while biofuel plants from Khaitan Bio Energy ensure round-the-clock reliability.

- Result: Stable, low-cost clean energy even when sun and wind drop.

Community Energy Hubs

- Rooftop solar and batteries keep homes resilient, while local biofuel supply chains add backup and reduce dependence on fossil fuels.

- Result: Stronger rural economies and reliable community power.

Green Mobility with Biofuels + EVs

- EV fleets charge on renewables, but bioethanol and fuel long-haul transport and hard-to-electrify vehicles.

- Result: Cleaner, cheaper mobility across both short and long distances.

Industrial Decarbonization

- Factories use a mix of solar/wind PPAs and biofuels for heat and power, with hydrogen emerging later.

- Result: Industries cut emissions faster while securing affordable energy.

Buildings of the Future

- Homes run on PV + heat pumps, with bio-based fuels covering peak or backup needs.

- Result: Lower bills, comfort, and resilience for households.

Risks and reality checks

- Policy whiplash: Incentives and rules can change, temporarily slowing adoption (as seen with EU heat pumps in 2024). Long-term economics still favor electrification + renewables, but stable frameworks matter.

- Grid bottlenecks: Transmission delays can strand cheap projects. Expect a greater push for grid-enhancing technologies and streamlined interconnection.

- Widespread adoption for 2G Ethanol: Currently most of the ethanol production is happening from Maize, sugarcane and rice, which directly affects food availability for the population. Adopting 2G Ethanol made using biomass not only does not eat into the food chain but also helps curb pollution by utilising rice straw to make ethanol which otherwise is burnt in open fields, leading to harmful fumes. Government needs to support policies for mass adoption of such technologies.

What “good” looks like by 2035

- Clean additions dominate: Renewable capacity keeps growing, but with a stronger mix—solar, wind, storage, and advanced biofuel power plants. Khaitan Bio Energy helps ensure that even agricultural residues and waste streams are turned into clean power, reducing both emissions and stubble burning.

- Round-the-clock portfolios: Utilities and corporations design energy packages that don’t just rely on the sun and wind. Biofuel-based power plants provide firm, dispatchable energy, complementing solar + wind + batteries. This ensures industries, hospitals, and AI-driven data centers get clean electricity even when the grid is under stress.

- Electrified living: EVs, rooftop PVs, heat pumps, and household batteries are standard, but the backbone of reliability comes from a steady supply of green fuels. By integrating biofuels into regional grids, companies like Khaitan BioEnergy make electrified lifestyles more affordable and stable.

- Early hydrogen and biofuel wins: Alongside green hydrogen pilots, bioethanol plants scale up to commercial levels. Refineries, fertilizers, and steel plants begin blending and switching to these green fuels, supported by Khaitan Bio Energy’s investments in 2G ethanol from crop residues. This not only cuts industrial emissions but also builds rural economies.

Bottom line About Rise of Renewable Synergies

The next decade is about connecting technologies: pairing renewables with storage, vehicles with grids, buildings with smart controls, and industry with green molecules. The economics are moving fast in favor of these combinations: record renewable additions, falling battery costs, strong EV sales, and surging corporate demand are all pointing the same way. If policy can keep pace—especially on grids and permitting Renewable Synergies— will do the heavy lifting for a cheaper, cleaner, and more reliable energy system by 2035.