India’s transport future is changing fast. In the last two years the country has moved from pilot projects and local experiments to nation-scale action on ethanol blending and alternative fuels. That shift is now meeting a second, powerful push from vehicle regulation: the next version of India’s Corporate Average Fuel Efficiency rules (often called CAFE-3) is expected to recognise flex-fuel engines alongside electric vehicles. That regulatory change makes it much more attractive for automakers to build cars that can run safely on petrol mixed with higher shares of ethanol . And it could reshape vehicle design, fuel markets, and farming economics across the country.

Why flex fuel matters right now

Ethanol blending has mushroomed into a national priority. The government’s Ethanol Blending with Petrol (EBP) programme, backed by policy and financial incentives. This pushed the blend target to 20% (E20) well ahead of schedule. By early 2025 India was already reporting blend levels close to or above 18–19% and aiming to hit or exceed 20% for the ethanol supply year. That means more pumps, more logistics, and more pressure on vehicle makers . This is to ensure cars can run on E20 without problems. A car that is “flex-fuel” can operate on a range of blends. From traditional petrol up to much higher ethanol mixes — allowing drivers to switch fuels without engine damage or performance loss.

What CAFE-3 is likely to change

CAFE rules set fleet-average emissions (or fuel efficiency) targets for manufacturers. Past iterations in India leaned heavily toward rewarding electric vehicles. The upcoming CAFE-3 is being talked about as more balanced. Not only will it keep pushing EVs, but it will also offer regulatory benefits to flex-fuel cars by allowing a “biogenic derogation” or other favourable accounting for emissions when biofuels are used. In plain terms, that lowers the effective emissions score for vehicles that run on biofuel blends. Thus making it cheaper for manufacturers to meet fleet targets if they add flex-fuel models. Automotive companies notice incentives like this quickly; when regulators reward a technology, product pipelines and investment plans shift fast.

How automakers are responding

Automakers in India are already moving. Major players — including legacy OEMs and newer manufacturers. Also they have stepped up development of flex-fuel powertrains, testing materials, fuel systems, and software calibration to cope with E20 and higher blends. Some are exploring flex-fuel versions of popular models. While others are investing in research partnerships and supplier upgrades to ensure parts resist ethanol’s different chemical properties. The carrot of CAFE-3 makes this work commercially sensible. A flex-fuel model could earn a manufacturer regulatory credits that count toward fleet compliance in 2027 and beyond. Reports show design pipelines and test programs accelerating in the past few months following official signals from transport ministry leaders.

Supply side: where will Ethanol will come from

Meeting higher blending targets depends on feedstock and capacity. India has broadened feedstocks beyond just sugarcane molasses to include B-heavy molasses, damaged or surplus rice, corn, and other grains when needed. For 2024–25 the USDA and other official tracking estimated India’s blending rate around 19.3 percent and noted that the government authorised large quantities of Food Corporation of India rice for ethanol to cover shortfalls from sugarcane. Thus diverting surplus foodgrain into fuel is a major, sometimes controversial move . But it shows how policy tools and market signals are being used to expand ethanol availability quickly. So practical outcome is that more ethanol will be available at more pumps. And so consumers can choose E20 without hunting for rare outlets.

Benefits

For drivers –

- More choice at the fuel pump.

- Cleaner combustion than pure petrol.

Environmental benefits –

- Ethanol burns cleaner, cutting some pollutants.

- Modest reduction in carbon intensity if produced sustainably.

For cities –

- Lower tailpipe emissions of carbon monoxide.

- Fewer particulate precursors → better air quality.

For the climate –

- Ethanol from residues or sustainable crops lowers lifecycle greenhouse gases.

- Second-generation (2G) ethanol from agricultural waste avoids using food crops.

Why it’s supported –

- Climate benefits attract funding from government and global partners.

- Support for second-gen projects and biofuel production clusters.

Concerns and trade-offs to watch

The shift is not risk-free. Using foodgrains for fuel can raise food security and price questions if not carefully managed. Ethanol production facilities have environmental impacts also. Distilleries can be pollution-intensive if wastewater and emissions aren’t controlled. Also some experts caution the EBP programme’s benefits depend on good feedstock choices and pollution controls. Similarly technical concerns also exist: older vehicles not designed for E20 could see diminished seals or fuel system issues unless manufacturers certify compatibility or consumers switch to flex-fuel models. That is why policy signals from the transport ministry and assurances from the petroleum ministry matters. Regulators must coordinate to ensure fuel standards, vehicle compatibility, and consumer information are aligned.

What CAFE-3 incentives mean for rural economies

- If flex-fuel cars become more common, ethanol demand will increase, directly benefiting farmers.

- Surplus rice can be used for ethanol production, creating new markets for farmers.

- Also sugar mills diverting sugarcane to ethanol will receive more payments, supporting the sugar industry.

- Incentives for growing energy crops could improve rural incomes across many regions.

- The government already offers higher prices for corn-based ethanol to encourage production.

- Viability Gap Funding is available for 2G ethanol projects that turn agricultural residues into fuel.

- This could create new value chains, such as:

- Small depots collecting crop stubble and residues

- Local distilleries processing ethanol

- New logistics and transport jobs

- Small depots collecting crop stubble and residues

- If managed well, farmers who currently burn residues could earn extra income instead.

- Social benefits will depend on transparent supply chains and ensuring food crops are not replaced by fuel crops.

What consumers should know today

Check your vehicle’s compatibility. Many new cars produced after 2023 are being built with E20 in mind. But older models or imports might not be compatible. Also follow the official guidance from manufacturers and fuel stations. The government has also clarified concerns that E20 will dramatically kill fuel efficiency or damage most modern engines — official statements and testing suggest impacts are manageable when standards are followed. Practical consumer steps include monitoring the label at the pump, checking manufacturer advice, and being alert to announcements about flex-fuel model launches from car makers.

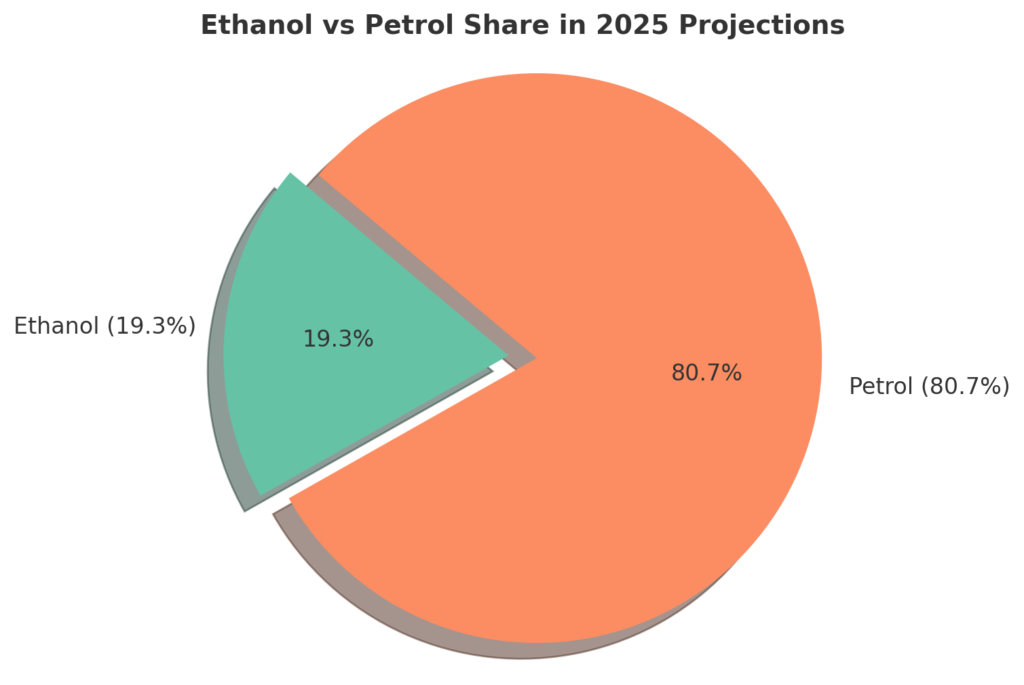

A quick way to see the scale of change is to think of the fuel pool as a pie. Projections from official sources put ethanol’s share of the petrol pool around 19.3% for 2025 — roughly one slice in five is now ethanol by volume. That is a huge shift compared with a few years ago when ethanol’s share was in single digits. Industry moves and likely timelines.

Also expect to see more announcements from vehicle makers about flex-fuel models between now and 2027. Pilot runs, certification tests, and the first small-series launches may happen as early as 2025–26, followed by wider rollouts if CAFE-3 final rules arrive as signalled for April 2027. At the same time, expect infrastructure work: more retail outlets stocking E20, upgrades in storage tanks and dispenser materials, and supply chain tweaks to avoid cross-contamination with unblended petrol. Investors in automotive components, pumps, and ethanol logistics will watch policy timelines closely because regulatory credits are what will turn R&D investments into near-term profit.

Global comparisons and lessons

Brazil is the classic example of a country that built a flex-fuel ecosystem and reaped both energy security and rural benefits. India is not copying Brazil exactly, but it is learning from that model while adding its own priorities — a heavy focus on second-generation feedstocks, careful targeting of surplus grains, and international partnerships to import best practices. The global takeaway is simple: policy clarity plus predictable incentives unlock private investment. If CAFE-3 gives clear, long-term recognition to flex fuels, India could accelerate a transition that balances EV growth with biofuel options in a complementary way.

What success looks like

Success would be a transport sector where consumers enjoy choice, emissions fall, farmers gain new markets for residues and surplus crops, and distilleries operate cleanly and transparently. So it would mean refurbished supply chains that don’t harm food availability, strict pollution controls for ethanol plants, and vehicle fleets where flex-fuel and electric options together help meet climate and air-quality goals. Therefore achieving this requires careful regulation, investment in cleaner ethanol routes (like 2G Ethanol), and strong monitoring to ensure public goods — food security and clean air.

Final thought

CAFE-3 is more than a technical update on paper. If it formally recognises the climate and fleet benefits of flex-fuel vehicles, that will change commercial logic for automakers and fuel suppliers. The result could be a genuine speed-up in ethanol-compatible cars on Indian roads by 2027, better use of agricultural residues, and an added lever to cut emissions from transport. The details will matter — the mix of feedstocks, the strength of pollution controls, and how incentives are structured — but the direction is clear: flex fuel is stepping onto the main stage alongside electric vehicles, and that could be one of the most practical ways India balances climate goals with energy security and rural livelihoods