Introduction

The story of ethanol in India is no longer about just “adding a bit of bio-fuel” — it’s about a major structural shift. In the bid to reduce oil import dependence, support farmers, and curb carbon emissions, the Indian government and oil marketing companies (OMCs) have committed to a massive offtake plan of ~1,048 crore litre for Ethanol Supply Year (ESY) 2025–26.

For ethanol producers and investors, this trend isn’t peripheral — it’s an opportunity (and challenge) that demands attention. Let’s break down what’s going on, why it matters, and what it means for ethanol producers.

What’s the plan?

What the numbers say

- OMCs invited bids for about 1,050 crore litres of ethanol supply for ESY 2025–26.

- They received offers from manufacturers totalling roughly 1,776 crore litres — far above the requirement, indicating strong producer interest.

- Then, allocations were made: around 1,048 crore litres allocated for supply in 2025–26.

- In this allocation, feedstock breakdown includes:

- Maize: ~45.68% (~478.9 crore litres)

- Rice (FCI surplus): ~22.25% (~233.3 crore litres)

- Sugarcane juice: ~15.82% (~165.9 crore litres)

- B-heavy molasses: ~10.54% (~110.5 crore litres)

- Damaged food grains and C-heavy molasses: smaller shares

- Maize: ~45.68% (~478.9 crore litres)

- Meanwhile, ethanol blending in petrol (under the EBP programme) reached ~19.05% as of July 2025.

In short: The government is doubling down on ethanol usage, the demand for different feedstocks is shifting (more grain-based, maize/rice rather than just sugarcane), and the supply side is gearing up accordingly.

Why is this happening? (Driving forces)

a) Blending targets and energy security

The Indian government set an ambitious target of 20% ethanol blending (2G ethanol) in petrol by 2025. By hitting blending rates of ~19% already, it appears India is on track — and the 1,048 crore litre allocation is part of that push.

Achieving this target helps in:

- Reducing crude oil import bills (each litre of ethanol replaces imported gasoline).

- Enhancing rural incomes (via new feedstocks, crop diversification)

- Lowering carbon emissions and improving air quality (bio-fuel emits less CO₂ than fossil fuels)

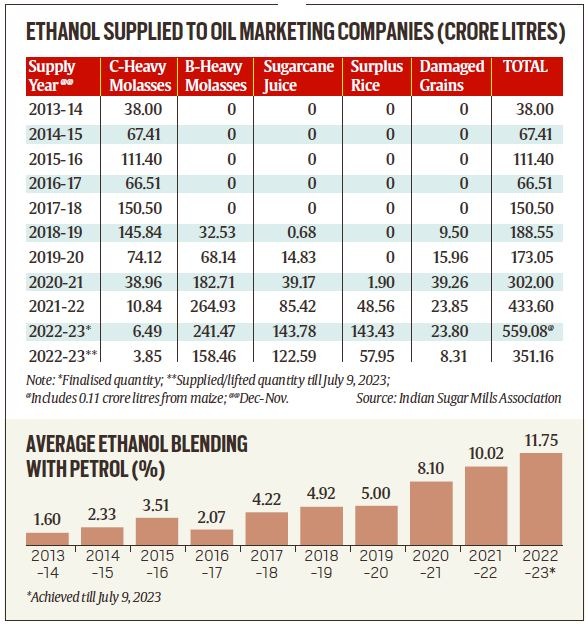

b) Changing feedstock mix

Previously, ethanol feedstock in India was heavily sugarcane/ molasses based. But the 2025-26 allocation shows a shift: maize (~45%), rice (~22%), sugarcane juice (~16%) and so on. This shift is significant because:

- It enables use of surplus grains/foodstocks and agri-residue, not just sugarcane.

- It spreads the risk of fuel feedstock across multiple crops, helping farmers of maize/rice too.

- It aligns with policies promoting advanced bio-fuels, feedstock diversification and circular economy.

c) Capacity build-up & policy support

Over the past decade, India’s ethanol production capacity jumped from very low levels to about 1,810 crore litres annually (by 2025) thanks to policy support.

Policies like interest-subsidy for distilleries, feedstock flexibility, higher purchase prices for certain feedstocks, and better infrastructure have helped.

What this means for ethanol producers

If you’re in the ethanol production business, here are the key take-aways:

Opportunities

- Large offtake guarantee: With OMCs committing to 1,048 crore litres, producers have a visible market.

- Higher margins: Diversified feedstocks (grains, maize, rice) may offer cost advantages or flexibility over sugarcane.

- Growth potential: As blending moves beyond E20 and feedstock diversification continues, room for expansion is high.

Challenges

- Feedstock risk: Ensuring consistent supply of maize, rice, molasses, etc. may require strong sourcing arrangements and logistics.

- Competitive bidding: Offers far exceeded requirements (~1,776 crore vs ~1,050 crore demand) meaning competition is heavy.

- Policy clarity: Although blending target is in sight, longer-term roadmap (post-E20) needs more clarity. For example, the industry asks for a “National Ethanol Mobility Roadmap 2030”.

- Infrastructure & logistics: Blending, storage, transport, distribution all need scaling up. Some supply chains may still be weak.

Quick Table: Key Figures & What They Imply

| Metric | Value | Implication for Producers |

| Allocation for ESY 2025-26 | ~1,048 crore litres | Large demand pool to tap into |

| Offers received | ~1,776 crore litres | High competition, need competitive cost structure |

| Blending achieved (July 2025) | ~19.05% | India is near E20 target — growth phase |

| Capacity of ethanol production | ~1,810 crore litres annual | Shows scale of industry; producers must operate at scale to benefit |

| Maize share in feedstock allocation | ~45.68% (~479 crore litres) | Grain-based feedstocks increasingly important |

What’s next & what to watch out for

- Post-E20 roadmap: While E20 is nearly reached, what happens beyond 2025? The government is already discussing a roadmap for higher blends.

- Feedstock innovations: Greater emphasis on 2G ethanol (from agri-residue) and waste feedstocks could open new margins.

- Global competitiveness: As the Indian ethanol industry grows, it may export or compete globally — cost, technology, logistics will matter.

- Infrastructure scaling: Storage, transport, blending facilities will need upgrading. OMCs, distillers, and producers will have to collaborate.

- Farmer & sector effects: Sugar-industry dynamics, maize/rice cropping decisions, and farmer incomes will all be influenced — risk (and opportunity) exists in the agriculture side too. For example, some sugar-industry bodies raised concerns about allocation fairness.

Conclusion

The new allocation of 1,048 crore litres for ESY 2025-26 is more than just a number — it truly marks a turning point for India’s ethanol and bio-fuel journey. For producers, it opens up a sizable and growing market; for agricultural value-chains, it spreads opportunity beyond sugarcane; and for companies like Khaitan Bio Energy, it offers a chance to scale and lead.

But the window won’t remain open for everyone without effort. Producers need to manage feedstocks smartly, operate efficiently, invest in technology, and stay ahead of policy shifts. If they do, the future of ethanol in India looks not just “greener”, but also bigger.